The Best Ways To Budget

Budgeting is the essential key to financial health. If you don’t have a physical plan that demonstrates where your money is going, you’ll end up wondering what you spent it on.

Accounting for every dollar you earn

The first step to budgeting is determining how much money you actually have to spend. (Consider your paycheck after taxes are taken out!) Budget all the way down to zero, which means, give every dollar you earn a purpose. Then, you need to determine which categories your paychecks go towards.

Typically, people will split these expenses into necessities, wants, and savings. Half of your money should go to necessities (yes - that’s our least favorite category, too). Think:

Housing

Groceries

Bills

Gas

Loans

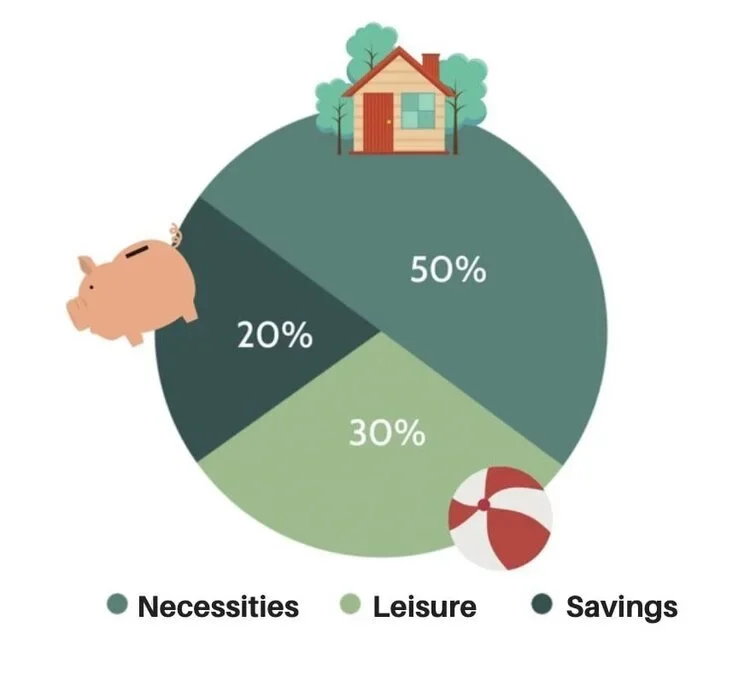

The 50-30-20 rule of saving money

Ideally, we want you to aim for 30% of the remaining funds to go into savings and the other 20% to go towards “fun” money (vacations, shopping, dining out, etc.) We know this isn’t always realistic, so if you save 20% and spend 30% on non-essentials, then you’ll be on the right track.

The other category of consumer loans is mortgage loans which, you guessed it, are for purchasing a home. These loans come in a few varieties. The first of which, ironically, is called a first mortgage that comes either as a fixed rate or variable rate - that adjusts over time based on market trends. The other variety of mortgage loans is a home equity loan that is also offered in two options.

The first is a fixed-rate second mortgage, and the second option is an adjustable-rate Home Equity Line of Credit (HELOC).

Credit union business loans

Credit unions, like banks, also offer business loans that are used for multiple different aspects of a business. These can include operating loans that can be used to purchase inventory or help with temporary cash shortfalls but also loans that help with start-ups, expansion, commercial real estate purchasing, and business credit cards!

Credit union member accounts

Savings accounts and checking accounts are fairly standard when it comes to credit unions and banks. Credit unions, however, do offer some interesting bonuses on their savings accounts. One of these bonuses is a Christmas/vacation feature that helps you put money aside for holidays or a trip that you want to help fund. Other saving options are available at credit unions that some might not think of like IRAs, safety deposit boxes, and term share certificates which are the same as a Certificate of Deposit CD provided by a bank!

Dividing your money into savings accounts

To easily visualize your money in these spaces, we suggest opening up accounts where you can see exactly where your dollars stand. Set pricing and bills that don’t tend to fluctuate in pricing (housing, water bill, etc.) should be put into one checking account, while other essentials that can vary (gas, groceries) should go into another. When your paycheck arrives, you can put the set amount into the first checking account and put an estimate into the other.

Whatever money is left in the flexible checking account can be put into savings or just carried over to the next month, allowing for extra money to go into your savings account when your next paycheck arrives.

paid my rent so don’t ask me to go out because i’m in the crib getting my moneys worth.

— chy (@politicallychy) October 1, 2018

The rule of thumb with savings accounts is to always have enough money to be able to get you by three-to-six months if an emergency were to occur. COVID-19 is living proof that emergency funds are extremely important, and though they’re certainly not fun to save for, they’re essential.

Designate one savings account to strictly just emergency funds. Emergency funds will look a little different for everyone but will have a general pattern. Those with pets may pull from it for unexpected vet bills, and others may pull from it to pay for expensive car parts if they drive a foreign vehicle. Either way, this account should not be used for those shoes or golf clubs that you absolutely “need.” (Don’t worry - we’re disappointed, too.)

Work hard, save hard, play hard

The last rule to budgeting is to leave room for fun! You work hard to earn your money so that you can not only live but enjoy life! Look at your remaining 20 - 30% each month and decide how much you can spend on vacations, shopping, accessories, activities, etc.

Dedicate a savings account to the big, fun savings, like vacations.

Vacation accounts are perfect for putting away big sums of “fun” money in order to have the best vacation possible (think luxurious hotels, delicious meals, and exciting excursions!).

Come visit our credit union

IN-PERSON OR ONLINE

Visit the AFL-CIO EFCU home page

MAIN BRANCH AND MAILING ADDRESS

555 New Jersey Avenue, NW, Suite 100

Washington DC, 20001

Hours of operation

Monday - Friday: 8:30am to 4:00pm

PHONE NUMBERS

Phone: (301) 683-2800

Fax: (202) 393-3137

24 HOUR TELEPHONE BANKING (AMIE)

Phone: (202) 637-8855